Fibonacci trading

What are Fibonacci numbers ?

🔹 Fibonacci numbers are a numerical series depicting nature’s expansion

🔹 The same number sequence appears all over throughout nature. i.e.

🔸 The number of petals on a flower

🔸 A snail shell

🔹 The sequence is made by simply starting at 1 and adding the previous number to arrive at the new number:

0+1=1, 1+1=2, 2+1=3, 3+2=5, 5+3=8, 8+5=13, 13+8=21, 21+13=34,…

🔹 Other important properties are the ratios when comparing any number to the number that is found 'X' places to the right:

🔸 0.618- A.k.a the "Golden Ratio" - where X = 1

🔸 0.382 - where X = 2

🔸 0.236 - where X = 3

🔹 It is these Ratios that have a correlation to market movements in terms of price and time cycle

🔹 We use them to provide targets for:

🔸 Price Extensions

🔸 Price Retracements

🔸 Time Cycles

How Fibs are used in Trading?

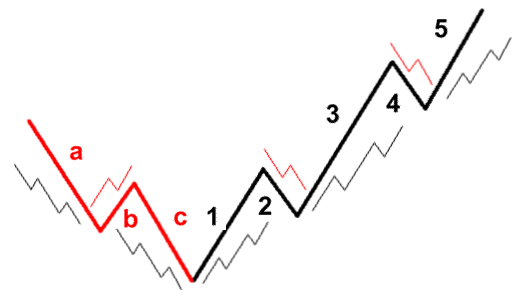

🔹 Firstly we need to talk very basic Wave Theory / Elliot Wave

🔹 While stock market prices may appear random and unpredictable, they actually follow predictable, natural laws and can be measured and forecast using Fibonacci numbers

🔹 Without going to deep, the basic principle is; waves move in Impulses & Corrections

🔸 Impulse waves (BLACK) are made up of 5 sub waves

🔸 Corrections (RED) are made up of 3 sub waves

🔹 Impulses & Corrections go in both directions

🔹 Waves are fractal in nature i.e. drill deeper & find the same patterns in a lower degree / time frame

🔹 Trend direction will determine if the impulse's are up or down

🔹 Elliot Wave has a lot more to it which i will cover another time

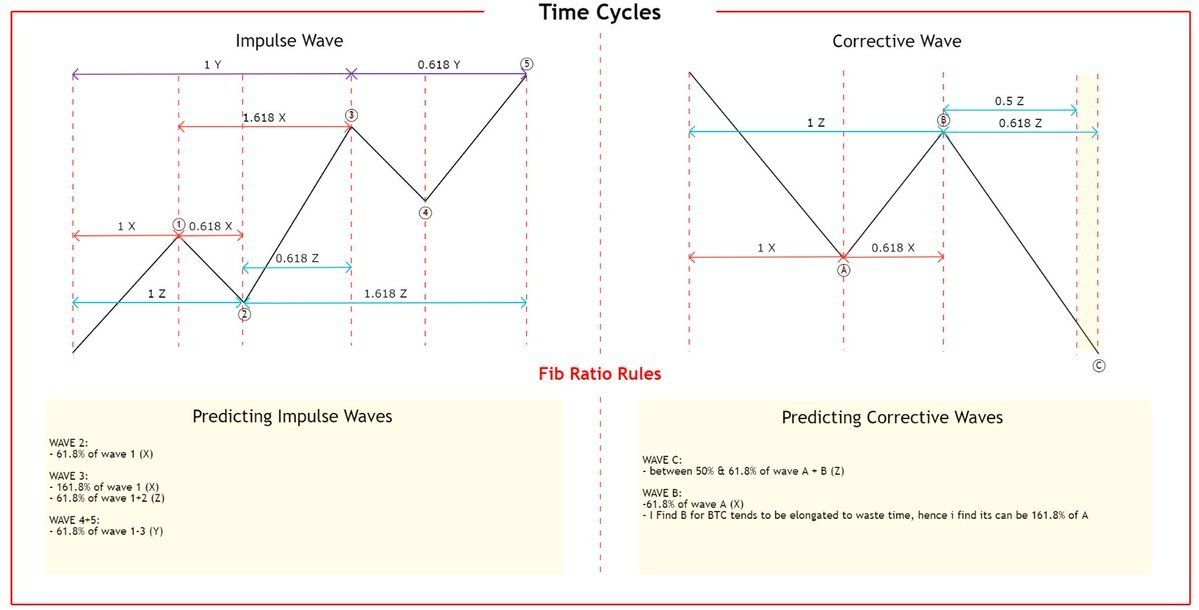

🔹 Fib Extensions, Retracements & Time Cycles help predict key price levels

🔹 Extensions, provide price targets

🔹 Retracements, provide areas of support and reversal

🔹 Time Cycles, give some indication of WHEN the wave will complete

Using Fib Extensions

🔹 Common Fibonacci extension levels are 61.8%, 100%, 161.8%, 200%, and 261.8%

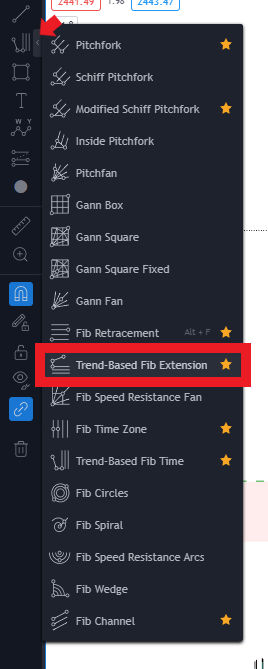

🔹 TradingView has a Trend-base Fib Extension tool that helps plot levels on a chart

🔹 See below for where to find the extension tool

🔹 I use Fib extensions to help predict where the next wave will finish

🔹 For impulse's and correction see the below for details and rules

Using Fib Retracements

🔹 Common Fibonacci retracements levels are 23.6%, 38.2%, 50%, 61.8%, 78.6% and 88.7%

🔹 TradingView has a Fib Retracement tool that helps plot levels on a chart

🔹 See below for where to find the Retracement tool

🔹 I use Fib retracements to help predict where the next wave opposite to the trend will finish

🔹 For impulse's and correction see the below for details and rules

Using Time Cycles

🔹 A little less know or used form of the Fib Ratios, is to use it to help determine time cycles

🔹 TradingView has a couple of Fib Time tool that helps plot levels on a chart

🔹 See below for where to find these tools

🔹 I use Fib Time tools to help me determine when i need to start paying more attention to a particular market

🔹 For impulse's and correction see the below for details and rules